top of page

Latest Weekly Market Summaries

Published every Friday

IPO Exit Activity & UK Markets & investments

Consulting Services

Articles Outlining Expertise

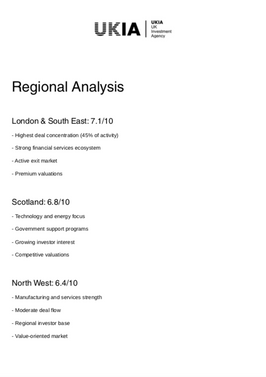

Three Markets

EIS Policy Impact Analysis Q3 2025

Released October 2025

Quarterly Assessment of Regulatory Changes & Investment Implications

Download: UKIA EIS Policy Impact Analysis Q3 2025

UK Private Equity Market Health Index

Released July 2025

Monthly Market Intelligence & Investment Climate Assessment

EIS Sector Performance Dashboard Q2 2024 - Q2 2025

Released July 2025

Comprehensive Market Analysis & Investment Intelligence Report

EIS & Private Equity Investor Guide

UK Investment Agency

A Brief Presentation Covering UKIA, Our Services & Market

Thank you for visiting our website

clientservices@ukia.uk

UK Investment Agency Limited

bottom of page